The Single Best Strategy To Use For chapter 7 bankruptcy

Martindale-Hubbell® Peer Critique Rankings™ are the gold typical in attorney rankings, and have already been for a lot more than a century. These scores indicate attorneys who're broadly respected by their friends for their moral expectations and legal experience in a certain location of observe.

Martindale-Hubbell® Peer Critique Rankings™ are the gold typical in attorney ratings, and are already for more than a century. These rankings reveal attorneys who're commonly highly regarded by their peers for his or her ethical standards and legal know-how in a particular space of exercise.

We also reference original research from other highly regarded publishers wherever acceptable. You may learn more in regards to the standards we comply with in developing exact, impartial content material in our

Whilst spouse and children regulation and bankruptcy problems might be frustrating and emotionally draining, Mr. Moreton takes a sensible approach to Every single of his conditions, working with consumer to ascertain their priorities and create a method tailored to the one of a kind requires and situation of their situation.

Whether or not your debts are secured or unsecured and priority or non-precedence, will effects your repayment sum and the order that your bankruptcy trustee will distribute your Chapter 13 prepare payments monthly.

Another step is to make sure if you created guarantees about secured debt – usually a house or auto, but in some cases a personal bank loan – you fulfilled All those promises.

We will be the experienced attorneys you want to give the intense illustration you would like as well as the customized assistance you have earned. Remember to Get in touch with us to agenda a No cost First... Read through Much more session with amongst our Attorneys for Wounded People.

Plenty of people today and families have already been left reeling financially just after economic downturns and sudden personal click reference crises, and bankruptcy can offer a strategic way from debt to financial flexibility.

The Bottom Line Chapter seven bankruptcy makes it possible for people and companies to eliminate most unsecured debts by liquidating non-exempt property, which has a court-appointed trustee overseeing the process. Debtors can keep exempt belongings, though non-exempt belongings are marketed to pay back check out this site creditors.

You will have heard of Chapter seven and Chapter 13 bankruptcy (Those people are the two most popular bankruptcies for people), but Are you aware there are actually six kinds of bankruptcy available? Below's a short rundown of the differing types of bankruptcy you could look here filings:

I really propose utilizing Upsolve for anybody who is monetarily unstable and wishes a way out of all of their financial debt and they do not feel like they will get ahead.

Chapter seven bankruptcy would not defend co-signers from being pursued by creditors. If description a debtor’s personal loan or financial debt has a co-signer, the creditor can nevertheless request repayment from your co-signer even read once the debtor’s obligation is discharged. Additionally, submitting for Chapter seven bankruptcy is often a make a difference of general public document.

SuperMoney hasn't existed so long as several of the referral platforms we evaluated and so there's not just as much consumer responses but. This is certainly a good way to assemble details about personalized financial loans there's a chance you're qualified for, however, you'll still have to finish your software immediately Along with the lender you end up picking.

The overall profits is then divided by 6 to ascertain the standard monthly profits. This determine is then annualized by multiplying it by twelve to compare it Together with the condition median money for the home of the identical measurement.

Alexa Vega Then & Now!

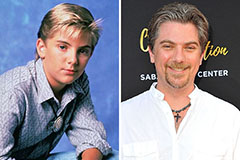

Alexa Vega Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!